Pragmatic research and design for a greenfield, enterprise project.

Background.

Innovation is difficult for large companies with entrenched processes and colleagues who, although having great tacit domain knowledge, lack the delivery mechanisms and support to articulate that knowledge in meaningful and productive ways to create benefits for their customers. This ever-decreasing circle of opportunity is both damaging and frustrating for all those involved.

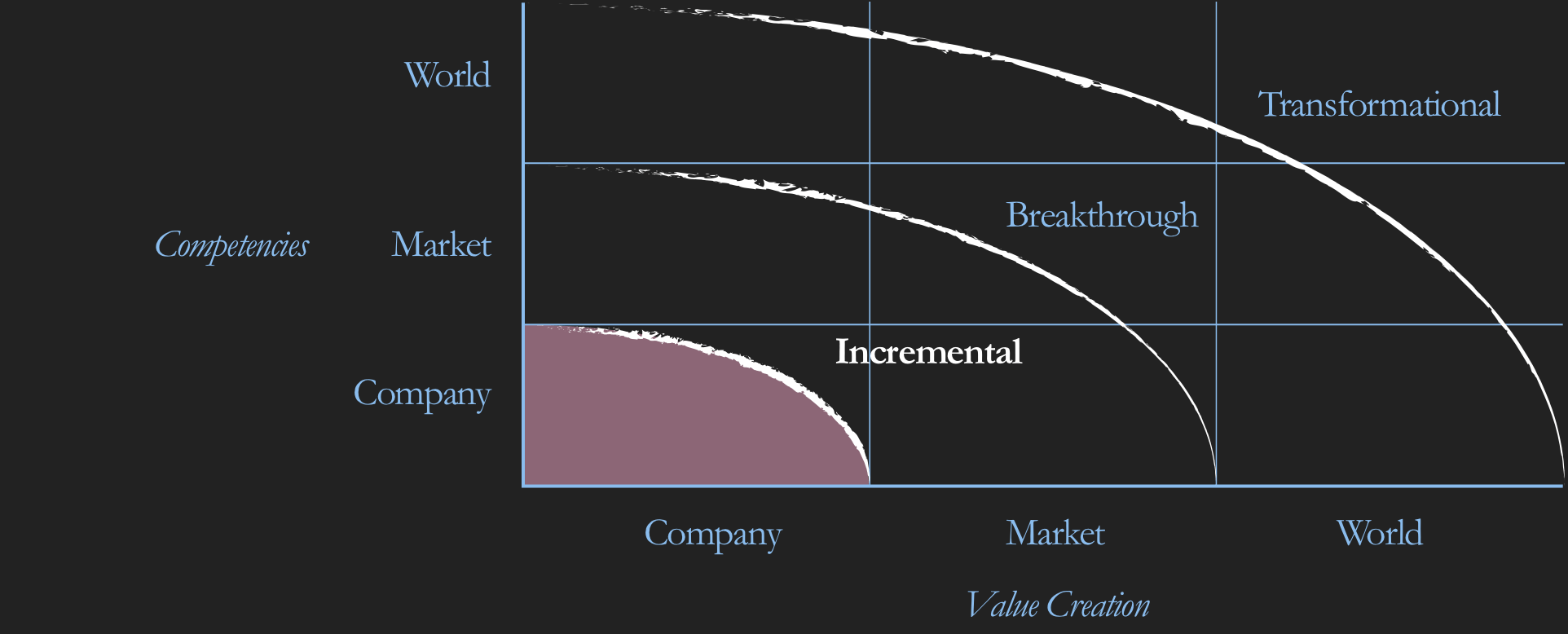

It’s known that innovation can occur at three different levels, incremental, breakthrough and transformational, while many companies aspire to initiate big-bang transformations or introduce breakthrough products or services, the reality is that for these companies, the best opportunity to innovate correctly is incrementally.

The inception of assumptions.

Program and project management offices (PMOs) are responsible for managing sets of inter-related projects in a coordinated way to improve the individual projects performances and ultimately increase the business, technology and business value; hence the value provided to the end customers. These offices work within parameters that seem, on the surface, broad reaching and comprehensive. They include:

- reducing time to market

- improving gross margins and cash flow

- increasing revenue

- understanding the total cost of ownership

- optimising outsourcing

- scheduling and productivity

- and aligning technology with business objectives

The typical PMO view of the world is lacking in two intertwined and fundamental ways, the first stifles innovation and the second externalises the responsibility of understanding the needs and wants of the customer to the ‘business’. These two things have a massive affect on all the other parameters; slowly sailing the ship off-course.

If one considers the PMO in the context of a contemporary framework such as SAFe, the capability is required to liaise with System Architects and Release Train Engineering to feed bodies of work in various streams, based on top-down, strategically coordinated requirements. In large organisations, these requirements are usually based on macro-insights and data gathered in house or from commissioned third-parties. but the customer doesn’t really have an integral part in all of the steps in the SAFe framework.

As a result of this, fundamental assumptions by governance regarding the customers sentiment towards a problem that a proposed product or service aims to resolve can’t be challenged and sense-checked effectively by program managers, product owners and customer advocates (such as researchers). As well as this, the onus is on business owners to provide the insights needed to steer the requirements through the narrow channel that governance has set; again, it’s not integrated into the process

NB: The latest version of SAFe does include the customer, but placing a user icon in the middle ofa diagram doesn’t constitute a customer-centred, integrated-insights framework; it’s more of an afterthought.

There are platforms such as Aha! that provide an environment that allow businesses to consolidate visions, strategies and roadmaps into a shared, collaborative view, they allow offer democratic idea boards that purport to represent the customer view. But these platforms are little more that garbage-in, garage-put glorified feeds. Where are the structures and processes (not just feeds) to align the insights to be consumed and actioned upon.

Outsourcing for the right type of innovation.

The increase in development agility these frameworks offer to organisations is not up for debate, however if governance, PMOs and product owners dedicated time and effort to manage customer insights with the same vigour as they do for development backlogs, they would be better placed to manage customer-centric changes - the right type of innovation.

No doubt, many of these organisations understand where the process gaps are and take steps to close them. To name a few: hiring an agency adept at vision-building to articulate one or engaging a consultancy to identify new technologies market segments may lean towards, externalising discovery to those with the tacit knowledge.

Problem space.

As with many major retailers, an online grocer and general merchandising client was finding it difficult to compete with new and aggressive online disruptors in Central Europe. In the UK, the online grocery market share is slowly being eradicated by the likes of Amazon; smaller players in various parts of the world feel they have a chance to take a bite of the apple, and Central Europe is no different.

The business needed to increase their customer reach without committing a tremendous amount of additional logistical and operational resource. Outsourcing ambient grocery fulfilment to third-party couriers. This presented a unique set of assumptions and problems that needed to be investigated and designed for.

As highlighted as a common occurrence in the background section, at the beginning of the engagement, the business didn’t take steps to assess if this new proposition would be attractive the the potential customer base and what customer problems it would solve. Not only that, the cost-benefit analysis and forecasting didn’t leverage any customer sentiment.

Time-stamped, contingent and ongoing processes.

Some of the initial canvassing and interviewing we undertook determined that:

-

Having groceries delivered by courier went against the natural expectations of online grocery shoppers.

-

Many customers in the new delivery areas would not be accustomed to online grocery shopping.

-

It may also be disconcerting for customers not be able to shop the full range of products because perishable items can’t be delivered.

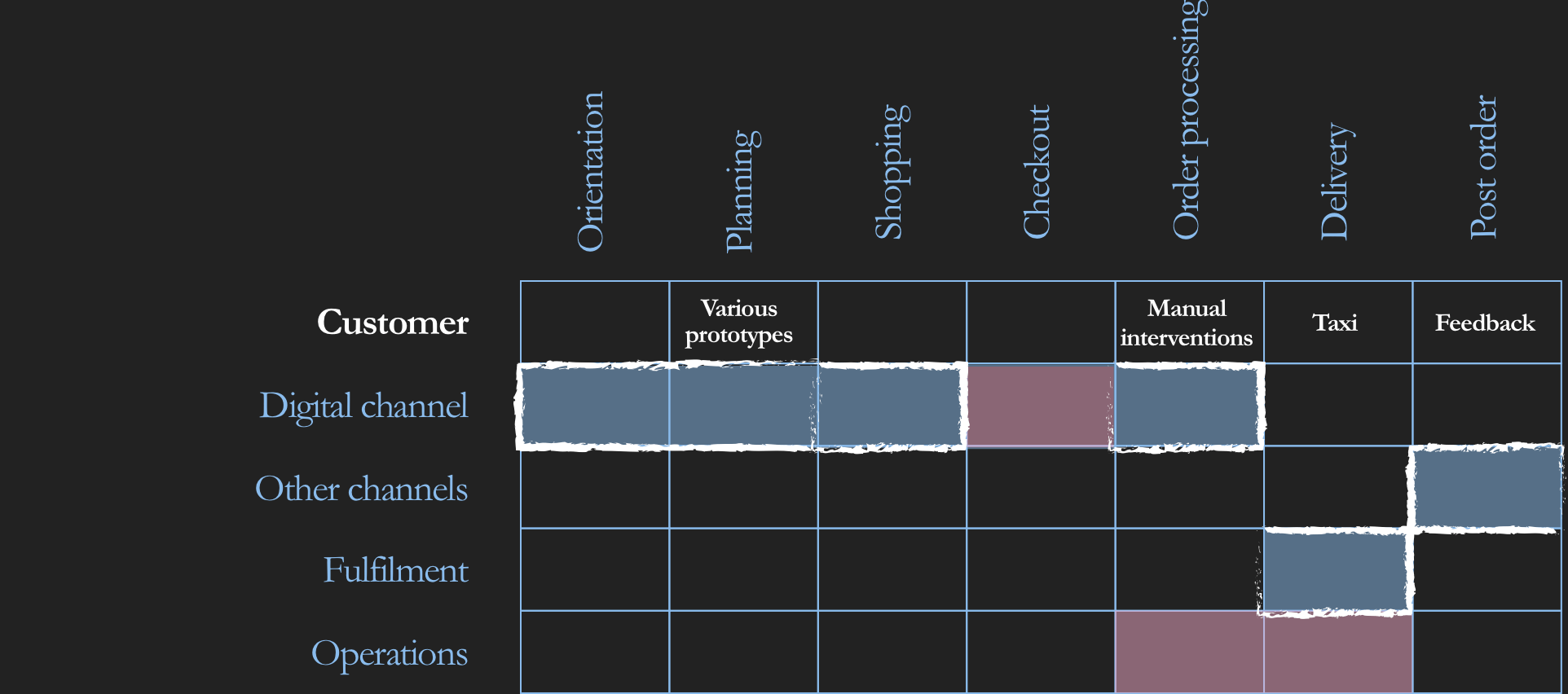

With a firm commitment to move forward non-the-less, work progressed further into discovery. At the early stages of the engagement, a working operational solution was already in development. So in order to maximise learnings in earnest, we created a concierge, end-to-end journey by:

- Creating a prototyped online shopping experience, tested in a research lab with carefully selected, potential customers

- The order details were then manually sent to the operating solution

- Operational issues were tracked as the order progressed through the solution.

- The order was delivered by a Taxi service

- The customer was asked to photo document the delivery and unboxing experience

- Post order telephone interviews were conducted.

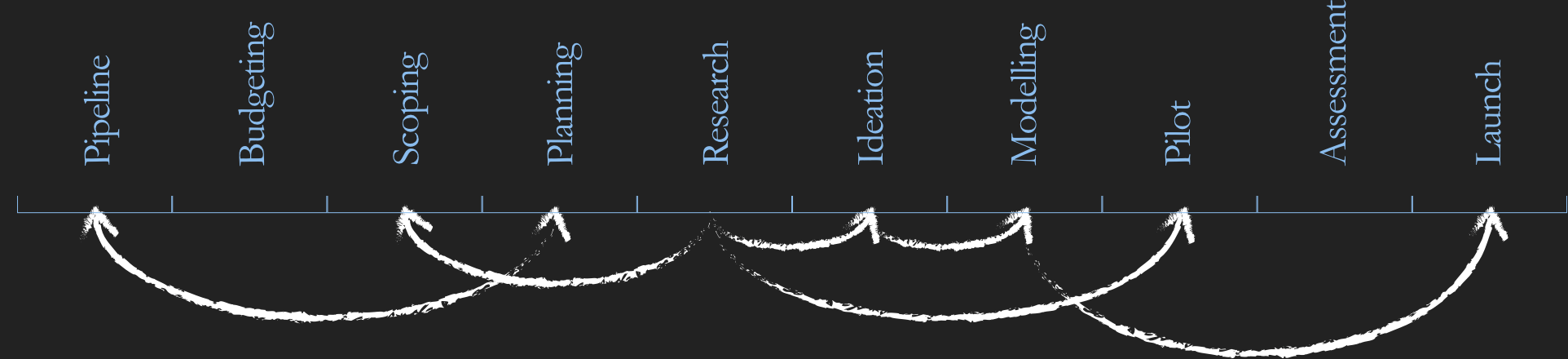

Based on the initial feedback the strategy became to minimise the amount of design and development effort for the initial pilot in favour of gradual improvements down the line by:

- Testing and learning through optimisation

- Iterating design enhancements for the online journey

- Undertaking cultural probes across various the countries

- Building archetypes of the ideal customers

- Further testing sentiment toward the proposition

- Piloting iterations in various towns with differing promotions across channels such as radio and ambient.

- Gaming the possible customer uptake to forecast how to make improvements.

Where we added additional value.

- Early insights for Governance and project level decisions.

- Helped steer the business away from risky strategies.

- Validated propositional designs quickly.

The value we added throughout the process opened doors for us the help the business improve overall research, design and development processes by helping them realise the potential that cold be unlocks by learning small and quickly and manoeuvring lightly through an continuously changing customer landscape.